Exploring the Different Types and Odds of Lottery Jackpots

In the United States, winners of a lottery jackpot can choose between an annuity that is paid out over 29 years or a lump sum payout. The lump sum option is a significantly smaller amount, and taxes will also reduce the prize money.

Lottery games are based on chance, so chances of winning are miniscule. However, people tend to overestimate the odds of good things happening to them and underestimate the odds of bad events occurring.

Game type

The odds of winning a lottery game can vary by the type of ticket purchased. The odds for Print ’n Play rolling jackpot games, for example, do not fluctuate based on the number of tickets sold. Instead, the odds of the top prize remain fixed at 1 in 240,000.

Slots are a classic example of chance-based gaming and one of the most popular forms of lottery-like games in casinos. Players push a button and the reels spin, with winnings based on the combinations of symbols that land on the reels. Some slots also include mini-games that offer additional chances to win.

While humans are good at developing an intuitive sense of the odds for risk and reward in their daily lives, that doesn’t work well when it comes to large jackpots, Matheson says. As a result, they tend to misunderstand how rare a big jackpot really is and continue to play. This is a good thing for lottery organizers, who are constantly introducing new games to keep their revenues growing.

Odds of winning

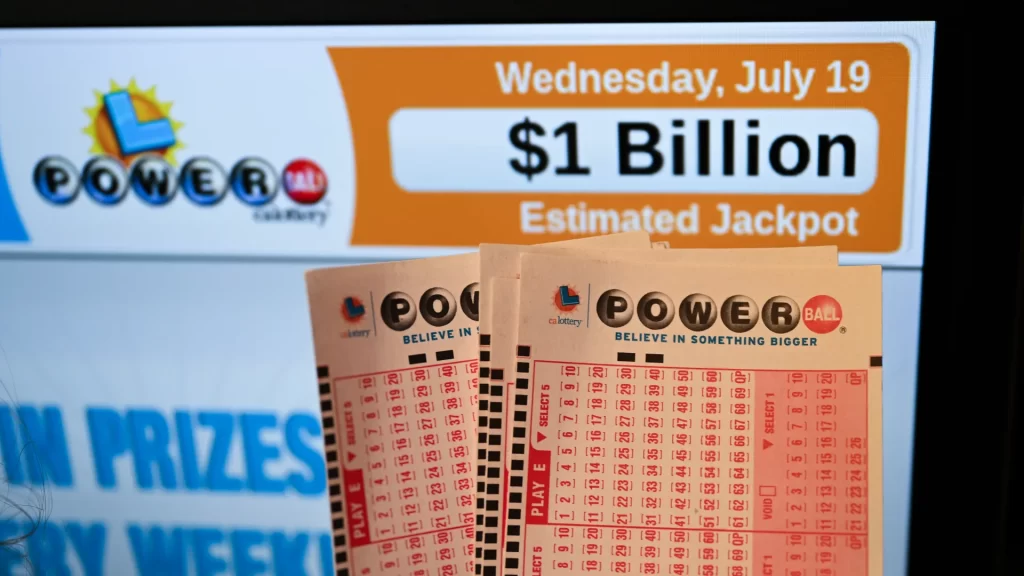

Lottery jackpots are reaching jaw-dropping levels, with Powerball and Mega Millions winnings frequently exceeding a billion dollars. But don’t get too excited: your chances of winning the top prize are still very slim. In fact, you’re much more likely to end up in the E.R. with a pogo stick injury or be killed by hornets than win the jackpot.

According to USC mathematics professor Kenneth Alexander, it doesn’t make financial sense to play the lottery. But many people do, spending $2 on a ticket to feel the thrill of the possibility that they could win.

But if you do win, it’s important to understand how that affects your tax situation. Most lotteries offer winners a choice of a lump sum payout or an annuity that pays out for a set number of years. Both options have their benefits, but which one is best for you?

Taxes on winnings

While winning the lottery is a dream come true, it can also be a nightmare. Lottery winners often find that federal and state taxes significantly decrease the amount of money they receive. This is why it’s important to speak with a financial or tax adviser before you win the lottery.

The US government taxes lottery winnings just like any other income. In fact, 24% of your winnings are automatically withheld by the IRS. You may also have to pay state taxes, depending on where you live and how much you won. However, some states do not tax lottery winnings at all. If you’re in one of these states, you should choose the lump sum payout option because you’ll save on taxes. On the other hand, if you’re in a high-income tax bracket, you may want to consider taking annual payments instead. It’s also a good idea to keep your winnings secret to prevent scammers from getting their hands on your cash.

Annuity options

When a lottery winner wins the jackpot, they can choose between taking a cash lump sum or an annuity payout. An annuity option reduces the tax burden, promotes financial planning, and protects against impulsive spending. However, it limits immediate access to funds and can limit investment opportunities. The alternative, a lump sum payout, can be invested in higher-risk investments that provide potentially greater returns.

While the lump-sum option offers more immediate flexibility, it also increases the tax bill. Annuity payments are typically spread out over 29 years and increase by a certain percentage yearly, reducing the winner’s total tax bill. This approach may also make it more difficult for winners to spend their winnings impulsively. However, it is important to consult with a financial professional before making this decision.